This month is my daughter’s 11th year anniversary with diabetes. On February 28th 2008 our lives changed. She was 7 years old. Next fall, she will be a junior at Georgetown College in Kentucky. So, this month I try to focus on diabetes care. This month I wanted to make emergency kits to keep on each floor of our house and one for her to take to the dorms. I only got one made, but the others will follow.

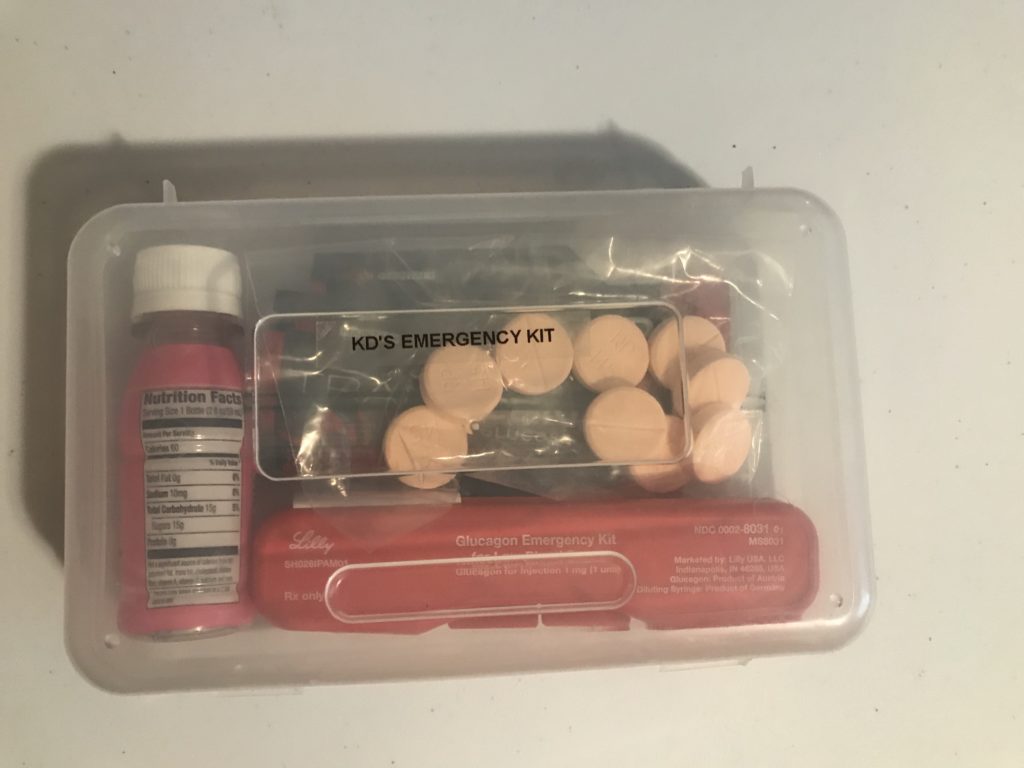

Supplies need:

- A school supplies box

- a Glucagon kit

- liquid gels either a bottle or packets

- sugar tablets

For her college one I intend on putting a laminated card with my name and number and her doctor’s name and number.

Here are some pictures of the finished project:

You can get the tablets or gel at any pharmacy. The glucagon is a prescription. The gel packs we get at Amazon. Here is the link:

Transend Glugose Gels-they come in different flavors, my daughter prefers the strawberry flavor. These have really been helpful and raise her blood sugar rapidly.

Ligia